How to Generate Leads for Reverse Mortgage Professionals in 2023?

In 2023, lead generation for reverse mortgage professionals will be more important than ever. With the rise of technology, customers are increasingly turning to online sources for alternative reverse mortgage solutions. This means that as a reverse mortgage professional, it’s essential to have strategies in place to generate leads.

Lead generation is the process of acquiring prospective customers to provide you with a steady source of business. Lead generation activities can help you build your clientele and grow your network, making it easier for you to stay current with trends in the industry.

When it comes to lead generation for reverse mortgage professionals, plenty of tools can help you quickly generate more qualified leads. With the right strategy in place, reverse mortgage professionals can generate more leads and be well on their way to success in 2023.

What Are Reverse Mortgage Leads?

For reverse mortgage professionals, lead generation involves various methods to identify, engage, and convert qualified prospects into leads. Consistent reverse mortgage leads are fundamental to the success of any reverse mortgage professional. With a steady stream of potential customers, it’s likely to maintain a thriving pipeline and build an effective business in the competitive world of reverse mortgages. Therefore, if you’re looking for ways to increase your profitability as a reverse mortgage professional, be sure to focus on finding new sources for quality leads!

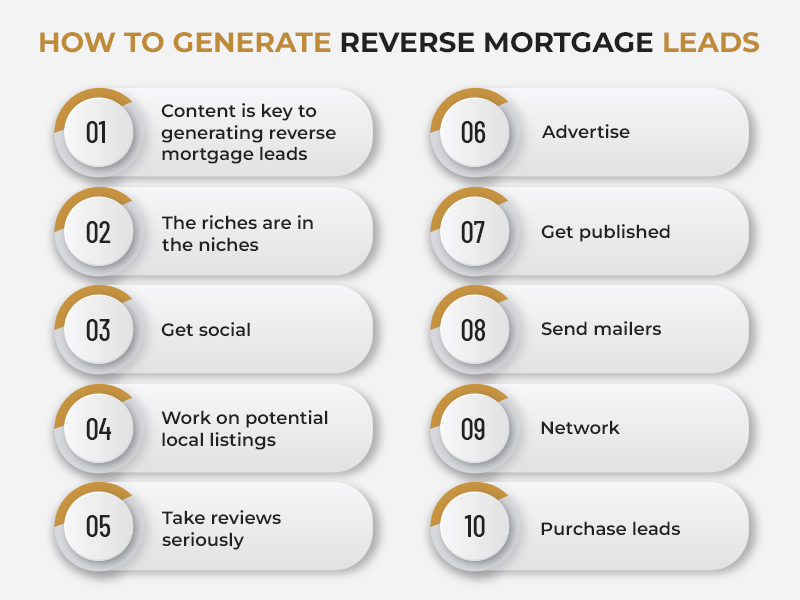

How To Generate Reverse Mortgage Leads

Fortunately, there are several simple ways you can generate more leads for your business. Here are ten ways to generate more leads for reverse mortgage professionals in 2023.

1. Content is key to generating reverse mortgage leads.

For your website to become a reliable source of leads, you must establish yourself as an authority in the reverse mortgage industry. In order to do this, traffic needs to be directed toward your website and first-time visitors need built trust. Moreover, offering incentives that will motivate people is also essential! All of these objectives require quality content from which potential customers can draw value.

If you want to start communicating with your prospects, written content should be the first place you look. Writing a blog is an effective way of tackling this — answer frequently asked questions about the reverse mortgage industry, talk about current trends, and even consider looking into local markets.

Don’t forget that potential customers can more easily consume other forms of content, so try creating:

- Images

- Videos

- Checklists

- Infographics

- Newsletters

2. The riches are in the niches.

This statement rings true for those in highly competitive industries. Are you an expert at something? If so, be sure to flaunt it! On the other hand, if your area of expertise needs to be improved or is nonexistent, take time to develop a strong strategy. If you specialize in reverse mortgages, that’s already a pretty specialized niche in the mortgage market. To give yourself your business the extra push it needs, consider the following:

- Find the edge you have over your competitors and use it in your communication strategy.

- Create valuable and educational information. Don’t leave out entertaining content as well!

- Position yourself as a niche expert by sharing your success stories or other areas that you specialize in.

3. Get social.

If you want to be an active participant in online conversations and make a lasting impression on social media, content is the key. Don’t just post sporadically — make sure your posting schedule it’s consistent and original! Here are some ideas to get started:

- Put your content in motion and share it with the world! Generate short videos to upload on YouTube, then leverage other social networks for further reach.

- Establish an engaged, passionate community of followers on Facebook!

- Provide helpful advice on Facebook, Twitter, and Instagram. Be sure to include links to your high-value content.

- Create a specialized network of followers on LinkedIn.

- Create groups on Facebook and LinkedIn.

- Showcase the joy of your customer’s journey by sharing photos from their closing day!

- Unleash the power of visual content by sharing it on Instagram and Pinterest.

- Build strong, lasting relationships that can lead to potential partnerships on LinkedIn.

4. Work on potential local listings.

Establish a no-cost Google My Business account to maximize visibility for your business. Ensure all the details listed on your profile are accurate and up-to-date. List your business on relevant local directories as well. By taking these simple steps, you can ensure that customers have quick access to information about where they can find you! Here are other benefits of creating a Google My Business listing:

- It helps your business appear in local search results.

- It enables you to collect reviews that build credibility.

- Shows your business in Google Maps.

5. Take reviews seriously.

Reviews are gold. They’re your most powerful weapon when it comes to gaining visibility in search engine results and establishing credibility on sites like Yelp. Think about your buying habits. It’s quite likely that reviews have been integral in deciding what movies to watch, what appliances to buy, which clothes to wear, and where the best places for dining and shopping are.

After closing a successful deal with a client, ask them to leave a review of your service online. For convenience’s sake, provide them with a direct link to your Google My Business page. Additionally, remember to express gratitude in any form — whether it be through recognition or an incentive of some kind!

6. Advertise

Take advantage of the power of digital marketing to promote your lending services, including:

- Social media advertising/sponsored posts

- Pay-per-click (PPC) on search engines

- Native advertising on discovery platforms

Tap into offline advertising opportunities with the following:

- Local print magazines

- Outdoor

- Newspapers

Read More: TOP 7 SOCIAL MEDIA MARKETING STRATEGIES FOR MORTGAGE PROFESSIONALS IN 2023

7. Get published.

To build your reverse mortgage presence, pen an article and submit it to a local magazine or newspaper or an online industry-relevant publication. This strategy is a powerful way of generating leads! You can also use LinkedIn for this same purpose.

8. Send mailers.

Developing relationships with your neighborhood is one of the most reliable ways to acquire reverse mortgage leads. To promote your best loan products and lending rates, create eye-catching flyers or mailers that will grab their attention. Here are some additional tips:

- Identify mortgage professionals with many listings in local magazines or by searching local reverse mortgage websites.

- Visit mortgage offices to introduce yourself and make initial contact. Ask how you can help meet their needs and grow their business. Follow up too.

- Visit open houses to build a relationship with real estate agents. Ask permission to leave business cards and brochures there.

9. Network.

Networking within the local community is not only beneficial but also essential when it comes to creating partnerships with realtors and other professionals in your area.

- Get involved in the community and lend your help by joining a local organization, like a PTA or charity. Give back to society through volunteering and serving on committees.

- Take part in trade shows and set up a booth to showcase your products or services at events.

- Connect with your personal network. Construct a list of acquaintances and colleagues, then reach out to them by sending a well-crafted letter that outlines the particulars of your services.

10. Purchase leads.

Aspiring to reach out to prospective customers who are on the hunt for loans? You can directly purchase reverse mortgages and refinancing leads — it’s that simple! Here are a few tips you should consider when buying reverse mortgage leads:

- Consider your budget: If you’re looking to save money, focus on the lead companies that accept a lower minimum amount. This way, you can find great deals without compromising quality!

- Preview the leads: When you opt to purchase leads from established providers, they often allow you to preview them first. Additionally, some of these firms provide useful filters that help you select leads that are suitable for your needs.

- Get answers: Before making any purchases, investigate where the company sources its leads. Avoid those that are simply repurposing or reselling them multiple times — these non-exclusive leads can cost up to five times more than fresh ones. However, exclusive leads come at a higher price yet give you access to unique prospects without exposure elsewhere.

- Consider customer service: Pay close attention to how the business conducts itself when communicating over the phone.

- Look for a return policy: To ensure a successful venture, research and find list providers with lenient return policies. Furthermore, peruse reviews to gain insight into the service you’re considering.

By investing time and resources into lead generation strategies, reverse mortgage professionals can find the right leads for their businesses and convert those leads into customers. Lead generation may take time to yield results, but by utilizing these tips, businesses will have an easier time generating qualified leads and growing their customer base in 2023.

The Bottom Line

The key to lead generation for reverse mortgage professionals in 2023 is creating a comprehensive plan that includes the strategies mentioned above. By creating an effective lead generation strategy, you’ll be able to find more qualified leads and increase sales quickly and efficiently. Social media campaigns, online lead generation tools, content marketing strategies, networking events, and paid lead generation services can all help you identify potential leads and convert them into customers. Lead generation may take some time to yield results, but if you stick with it, you’ll soon be generating more business than ever before. Good luck!

Hiring a digital marketing agency is cost-effective for companies looking to improve sales and grow their business. Digital marketing agencies help companies attract new customers, improve brand awareness, and generate more revenue.

Ready to start growing your business with Gold Lion Technologies? Our goal is to help businesses reach their goals and to be the leading solution for their clients. Contact Us for a FREE business audit.